Introduction:

Ever wonder who’s leading the world’s top 10 insurance giants in 2025? These are the biggest players, ranked by their market value—a number showing how much the world trusts them to keep us safe when life throws curveballs, like a flooded basement or a surprise doctor’s visit. Think of it like a report card for the insurance industry’s heavy hitters! These companies aren’t just about money—they protect millions of homes, cars, and families every day. From the U.S. to Asia, they’re the unsung heroes ensuring we’re okay when things go sideways.

Today, we’re counting down the top 10 insurance giants of 2025 by market value. Their size will blow your mind, and their stories are pretty cool too! Want the basics on insurance? Check out here for Understanding Term Life Insurance. Ready to meet these big shots who’ve got the world covered? Let’s jump right in and see who’s leading the pack!

Table of Contents

What’s Market Value Anyway?

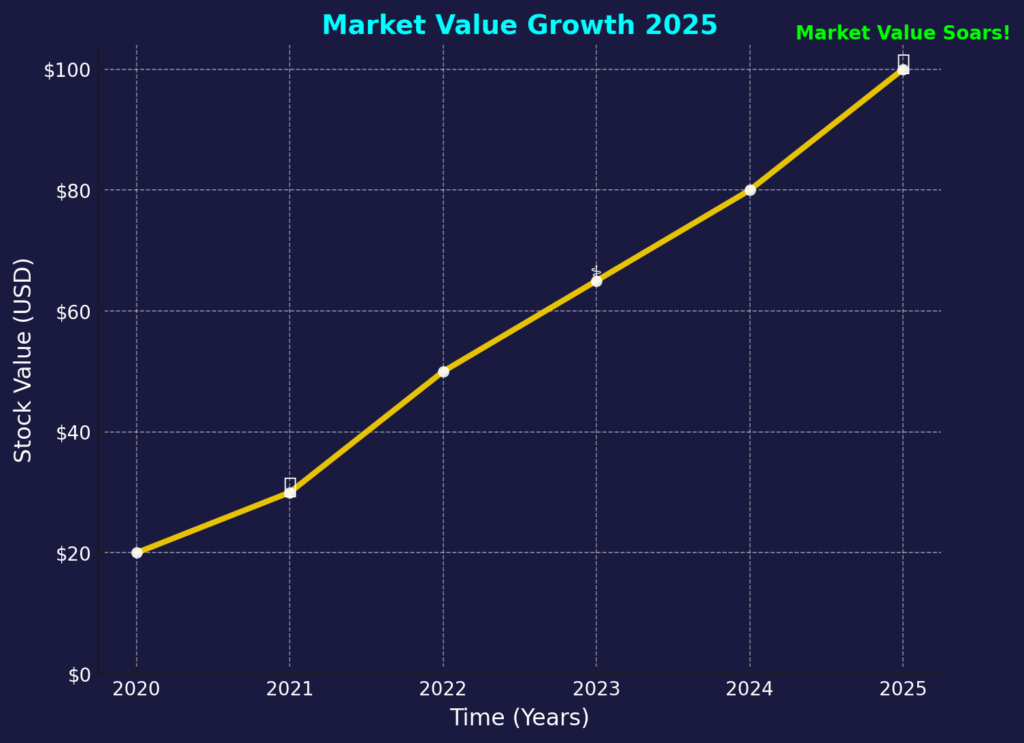

Okay, let’s keep this simple—market value is how much a company’s worth if you add up all its stock. Imagine you’ve got a little bakery, and folks love your cookies so much they’re willing to buy shares in it. If you’ve got 100 shares at $2 each, your bakery’s market value is $200. Easy, right? For these insurance giants, it’s the same deal: take the price of one share and multiply it by how many shares are out there. It’s like a popularity contest—who’s got the most fans betting on them? A big market value means people trust them to stick around and do a great job.

It’s not about how much cash they’ve got piled up or how many policies they sell—it’s about what the stock market thinks the worth of their valuations. For these World’s Top 10 Insurance Giants by Market Value in 2025 insurance companies, that’s huge because they need trust to keep us signing up for their plans. Whether it’s covering a car crash or a hospital bill, a high market value says, “Hey, we’ve got this!” Curious about how credit scores play into this? Why Your Credit Score Affects Insurance is important? So, as we look at the top 10, keep this in mind—it’s their ticket to the big leagues. Pretty neat way to measure these heroes, huh?

The Insurance World in 2025: A Quick Look:

Picture a giant safety net stretching across the globe—that’s insurance in 2025! This industry’s worth trillions of dollars, catching us when life gets messy—like when a storm trashes your roof or you need surgery out of the blue. Right now, it’s buzzing with action. Let’s break it down and analyse details about the World’s Top 10 Insurance Giants.

Tech Shaking Things Up:

Tech’s changing the game—think apps that let you buy insurance in minutes or smart tools that predict floods before they hit. Companies are racing to keep up! Whole Life Insurance Lifelong Security dives deeper into how tech shapes lifelong coverage.

Big Challenges and Growth:

But it’s not all smooth sailing—big weather events and health worries keep these companies busy. The U.S. is still the heavyweight champ, home to tons of these giants, but Asia’s coming in hot, especially China and Hong Kong, where millions are jumping on the insurance train. Why? More folks are buying cars, homes, and health plans as life speeds up. Take China, for example—cities are booming, and people want protection for their Home and Property. Meanwhile, in Europe, companies like Germany’s Allianz are old pros at this game.

In 2025, these giants are like the world’s babysitters, watching over us with one eye on the future—like climate change or new tech. They’re busy, they’re growing, and they’re making sure we’re okay no matter what. Want global trends? Here are the details about the Top Rated Insurance Companies of the US has the scoop on U.S. leaders. Let’s meet the top 10 stars lighting up this wild, wonderful insurance world!

The Top 10 Insurance Stars of 2025:

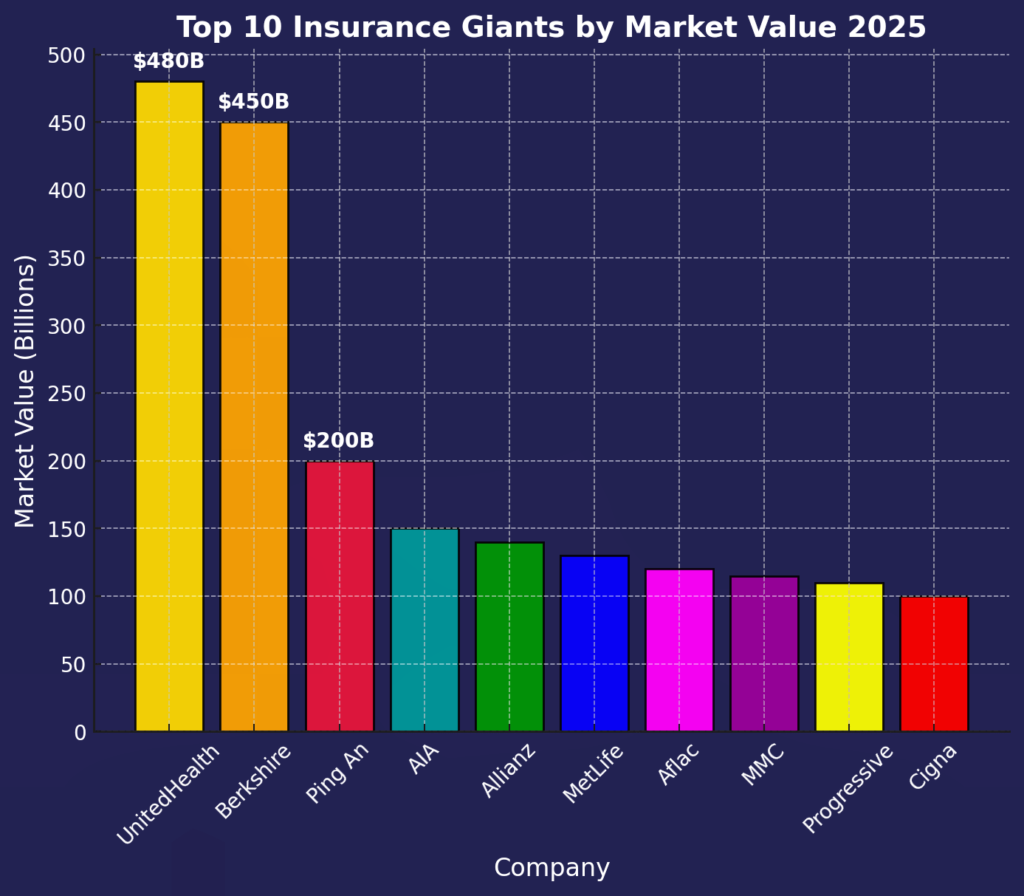

Here they are—the biggest insurance heroes of 2025, ranked by market value! Since it’s only March 16, 2025, we’re guessing a bit based on late 2024 numbers (think Statista and AM Best vibes), but these are the ones to watch. Let’s count down from 10 to 1 and get to know these champs!

10. The Cigna Group:

- Market Value: Around $100 billion (based on 2024’s $99.9 billion)

- Where They’re From: USA, Bloomfield, Connecticut

- What They Do: Cigna’s your go-to for health stuff—doctor visits, prescriptions, even therapy to keep your mind happy. They’re all about keeping millions healthy across the globe.

- Why They’re Big: They’re pros at teaming up with companies to cover workers—like your boss’s health plan might be Cigna! They’re also growing like crazy in Asia, where more folks want wellness help.

- Little Nugget: They kicked off in 1792 as a tiny outfit—now they’re a health giant with over 70,000 employees!

9. Progressive Corporation:

- Market Value: About $110 billion (up from $103 billion in 2024)

- Where They’re From: USA, Mayfield Village, Ohio

- What They Do: Progressive’s got your wheels covered—cars, motorcycles, boats, even RVs! If it moves, they insure it.

- Why They’re Big: You’ve seen Flo in their ads, right? She’s made them a household name. Plus, their online tools make getting a quote a snap—drivers can’t get enough!

- Little Nugget: Two guys started it in 1937 with a dream and a love for risks—now they cover over 20 million vehicles!

8. Marsh & McLennan Companies (MMC):

- Market Value: Roughly $115 billion (from $112 billion in 2024)

- Where They’re From: USA, New York City

- What They Do: MMC’s like the brains behind the scenes—they help businesses figure out risks (think cyberattacks or hurricanes) and pick the perfect insurance.

- Why They’re Big: They advise 95% of America’s top 500 companies—huge names trust them to dodge disasters! They’re quiet giants with loud impact.

- Little Nugget: With 85,000 people in 130 countries, they’re everywhere, solving problems daily!

7. Aflac Incorporated:

- Market Value: Around $120 billion (up from $117 billion in 2024)

- Where They’re From: USA, Columbus, Georgia

- What They Do: Aflac gives you extra cash when you’re sick—like for hospital stays or missed work—on top of regular health plans.

- Why They’re Big: That duck quacking in their ads? It’s iconic! They’re also massive in Japan, covering one in four households there—wild!

- Little Nugget: Three brothers launched it in 1955 with $4,000—now it’s a global star!

6. MetLife, Inc.:

- Market Value: About $130 billion (from $125 billion in 2024)

- Where They’re From: USA, New York City

- What They Do: MetLife’s your family’s shield—life insurance, retirement savings, even dental plans to keep those smiles bright.

- Why They’re Big: They’ve been around 150+ years and cover millions in over 40 countries. They’re steady as a rock!

- Little Nugget: Their old Snoopy ads on the blimp still make folks nostalgic—he’s their unofficial mascot!

5. Allianz SE:

- Market Value: Around $140 billion (based on $135 billion in 2024)

- Where They’re From: Germany, Munich

- What They Do: Allianz does it all—car insurance, home coverage, health plans—across every corner of the world.

- Why They’re Big: They’re Europe’s insurance champs, handling giant risks like floods or factory fires with ease. Over 100 million customers swear by them!

- Little Nugget: Born in 1890, they’ve insured everything from ships to the Olympics—talk about range!

4. AIA Group Limited:

- Market Value: Roughly $150 billion (from $145 billion in 2024)

- Where They’re From: Hong Kong

- What They Do: AIA’s big on life and health insurance, especially in Asia—think China, Thailand, and Singapore. They keep families secure.

- Why They’re Big: Asia’s growing fast, and AIA’s right there with affordable plans. They’ve got 40 million policies out there!

- Little Nugget: It started in a cramped Shanghai office in 1919—now it’s an Asian powerhouse!

3. Ping An Insurance Group:

- Market Value: About $200 billion (up from $190 billion in 2024)

- Where They’re From: China, Shenzhen

- What They Do: Ping An’s a multitasker—life insurance, health, cars, even banking. They’ve got it all covered!

- Why They’re Big: They use tech like AI to make insurance fast and easy for 220 million clients. In China, they’re unbeatable!

- Little Nugget: Their “AskBob” AI chats with agents to boost sales—future stuff happening now!

2. Berkshire Hathaway Inc.:

- Market Value: Around $450 billion (from $440 billion in 2024)

- Where They’re From: USA, Omaha, Nebraska

- What They Do: Warren Buffett’s crew owns GEICO and insures homes, planes—pretty much anything you can imagine!

- Why They’re Big: Buffett’s a legend at picking winners, and their insurance arm pumps out cash like a fountain. They’re unstoppable!

- Little Nugget: It began as a textile mill in 1839—now it’s a $900 billion empire counting everything!

1. UnitedHealth Group:

- Market Value: Roughly $480 billion (down from $500 billion pre-2024 drama)

- Where They’re From: USA, Minnetonka, Minnesota

- What They Do: UnitedHealth rules health insurance—covering doctor visits, surgeries, and more for millions.

- Why They’re Big: They’ve got 85,000 doctors and nurses on call and reach 150+ countries. Even a rough 2024 couldn’t knock them off the top!

- Little Nugget: After losing CEO Brian Thompson in 2024, they bounced back strong—resilient champs!

How Do They Stack Up?

These are the World’s Top 10 Insurance companies Wow, what a crew! The U.S. dominates with six of these giants—guess they’re the insurance capitals of the world! Asia’s no slouch, though—China’s Ping An and Hong Kong’s AIA show the East is rising fast. Some, like UnitedHealth and Cigna, are health-focused, while Progressive and Allianz cover cars and homes. The gap’s huge—number one’s worth nearly five times number 10! It’s like a global relay race, with each company passing the baton to keep us safe.

Europe’s Allianz holds strong too, proving old-school skills still rock. What’s cool is how different they are—some bet on tech, others on trust built over decades on Term vs Whole Life Insurance comparison. Together, they’re a dream team making sure the world keeps spinning, no matter what hits us in 2025. Want to compare different health plans? for details you may check here for Best Health Insurance Plan. Pretty amazing to see them side by side, right?

What Makes These Giants Grow?

So, how do these Global Insurance stars get so big? It’s all about trust and smarts! Here’s the breakdown:

- Happy Customers: They cover us well—150 million rely on UnitedHealth alone for Understanding about Medicare.

- Smart Tech: Ping An’s AI speeds things up, and Progressive’s app makes claims a breeze.

- Big Risk Masters: Allianz tackles floods, while MMC dodges cyberattacks for businesses.

They’re like wizards with a crystal ball, seeing what’s coming! In 2025, staying ahead means adapting—more folks want coverage as storms rage or health needs grow. They win by keeping it simple: be there when we need them, whether it’s a car wreck or a retirement plan. These giants are the superheroes of planning, growing bigger every time they save the day. Neat trick, huh?

Wrapping Up: The Future’s Safe with Them:

There we go— the top 10 Global insurance giants of 2025! From UnitedHealth’s health empire to Berkshire’s everything-under-the-sun approach, they’re the world’s safety squad. They’ve got billions in market value because they’ve earned the trust from millions of people. As 2025 rolls on, they’ll keep growing—life’s getting wilder, and we need them more than ever.

Whether it’s a storm, a health scare, or just peace of mind, these champs have us covered. Who’s your favorite? I’m torn between Progressive’s cool vibes and Ping An’s tech magic—tell me yours below! For now, one thing’s clear: with these heroes around, the future’s looking safe and sound. Here’s to the big shots keeping our world steady!

Data Sources: Where We Got the Scoop:

Wondering where we dug up all this info about World’s Top 10 Insurance Giants ? We’ve leaned on some trusty spots to build this 2025 list! First, Statista gave us killer market cap stats—like UnitedHealth’s $473 billion in January 2025. Then, AM Best offered insights on insurance rankings and trends—super helpful for spotting the big players. We also peeked at Visual Capitalist for fresh 2024 data visuals, projecting them into 2025 since it’s only March now. Finally, Yahoo Finance chipped in with stock updates to keep our numbers sharp. These sources are goldmines for finance geeks, and we’ve mixed their latest bits with a sprinkle of guesswork to bring you this countdown. Want the exact 2025 figures? Check these sites later this year when the dust settles!

Disclaimer: A Quick Heads-Up:

Hey, just a little note before you dive too deep! This article’s a fun snapshot of the world’s top 10 insurance giants by market value in 2025, based on 2024 trends and some smart guesses as of March 16, 2025. Numbers like $480 billion for UnitedHealth? They’re projections, not gospel—stock markets shift fast! We’re not financial advisors, so don’t take this as investment advice—chat with a pro if you’re eyeing stocks. Data comes from solid spots like Statista and AM Best, but 2025’s full story isn’t out yet. Companies could climb or dip by year-end, so double-check later for the real deal. This is for info and enjoyment—think of it as a peek at the insurance world, not a crystal ball. Enjoy the read, and use it as a starting point, not the final word!